As the digital era continues to evolve, traditional accounting methods no longer suffice, and businesses need a streamlined solution to handle their financial operations. Enter Xero, a game-changing accounting software that has been making waves in the world of small business accounting.

Xero, founded in 2006, has grown to become a market leader in cloud accounting, with 3.7 million subscribers across New Zealand, Australia, and the United Kingdom. This article will delve into the world of Xero, exploring its remarkable features and functionalities, as well as how it can transform the way small businesses manage their finances.

Pay Bills and Streamline Your Financial Operations

Managing accounts payable is an integral part of any business, but it can be a time-consuming and error-prone process. Xero’s accounting software simplifies this task by allowing users to track and pay bills on time. This feature provides a clear overview of accounts payable and cash flow, ensuring that businesses can stay on top of their financial obligations.

VAT Returns Made Simple

Value Added Tax (VAT) is a significant financial aspect for businesses, and Xero recognizes this. The software calculates VAT and files VAT returns securely online with HMRC (Her Majesty’s Revenue and Customs) in the UK, using software that is fully compatible with HMRC systems. This streamlined approach to VAT returns reduces the burden on businesses and helps ensure compliance with tax regulations.

Efficient Expense Management

Managing employee expenses can be a hassle without the right tools. Xero’s expense manager tools make it easy to capture expense claims, track and manage employee spending, and streamline the reimbursement process. This feature simplifies expense tracking and empowers businesses to keep a tight grip on their financials.

Seamless Bank Connections

Xero’s integration with over 21,000 financial institutions worldwide makes it easier than ever to connect your bank data to the platform. This feature is a time-saver, as Xero customers report saving an average of 5.5 hours per week using bank feeds and automated reconciliation. Accurate and up-to-date financial data is at your fingertips, reducing manual data entry and minimizing errors.

Accept Payments Your Way

Getting paid on time is crucial for any business, and Xero makes it simple to accept online payments. Whether it’s by credit card, debit card, or direct debit, Xero allows customers to pay the way they prefer. This feature not only increases the likelihood of timely payments but also reduces the time spent chasing payments.

Efficient Project Tracking

For businesses that deal with projects and jobs, Xero offers a project and job tracker software that allows you to quote, invoice, and get paid efficiently. Moreover, you can keep a close eye on costs and profitability, ensuring that your projects stay on track and within budget.

Streamlined Payroll

Xero’s online payroll software is recognized by HMRC, making it a reliable solution for paying yourself and your employees. This payroll software automates tax, pay, and pension calculations, simplifying the often complex and time-consuming payroll process.

Bank Reconciliation Made Easy

Ensuring that your account balances and financial records align is vital for financial accuracy. Xero’s bank reconciliation software streamlines this process, making it easy to confirm that the transactions in your bank accounts are accurately recorded in your business financial records.

Contact Management Simplified

Using Xero for contact management centralizes information about your customers and suppliers. You can access details of sales, invoices, and payments in one place, making it easier to maintain strong relationships with your business contacts.

Effortless Data Capture

Xero’s Hubdoc tool automates data capture by getting copies of documents and key data into the system automatically. This feature simplifies record-keeping and document management, saving you time and reducing the risk of data entry errors.

Convenient Online File Storage

Xero offers online file storage, allowing you to manage and share documents, contracts, bills, and receipts securely from anywhere. This cloud-based file management system enhances collaboration and ensures that your important documents are accessible whenever you need them.

Comprehensive Reporting

Accurate accounting reports are essential for tracking your finances and making informed business decisions. With Xero, you can access a range of accounting reports and collaborate with your financial advisor in real-time. This feature empowers you with the insights needed to steer your business in the right direction.

Inventory Management

Xero’s inventory control system helps businesses keep track of stock levels efficiently. This system also populates invoices and orders with items you buy and sell, ensuring that your inventory is always up to date.

Online Invoicing for Greater Efficiency

Invoicing is a fundamental aspect of any business, and Xero’s intuitive invoicing software simplifies the process. You can log in from your desktop or mobile app and send invoices as soon as the job is completed. This streamlined approach to invoicing reduces delays in payments and helps improve your cash flow.

Multi-Currency Accounting

In an increasingly globalized world, businesses often deal with multiple currencies. Xero enables users to pay and get paid in over 160 currencies, offering instant currency conversion. This feature is invaluable for businesses engaged in international transactions.

Simplifying Purchase Orders

With Xero’s purchase order software, you can create and send digital purchase orders seamlessly. This cloud-based system allows you to track orders and deliveries at every step, providing transparency and efficiency in the procurement process.

Professional Online Quotes

Creating and sending professional online quotes is a breeze with Xero’s desktop software or mobile app. Businesses can send quotes instantly, helping them secure new projects and clients quickly.

In-Depth Analytics

Understanding your business’s financial health and future cash flow is essential for making informed decisions. Xero provides analytics tools that allow you to check financial metrics and track your business’s overall health. Businesses can also upgrade to Xero Analytics Plus for even more in-depth insights.

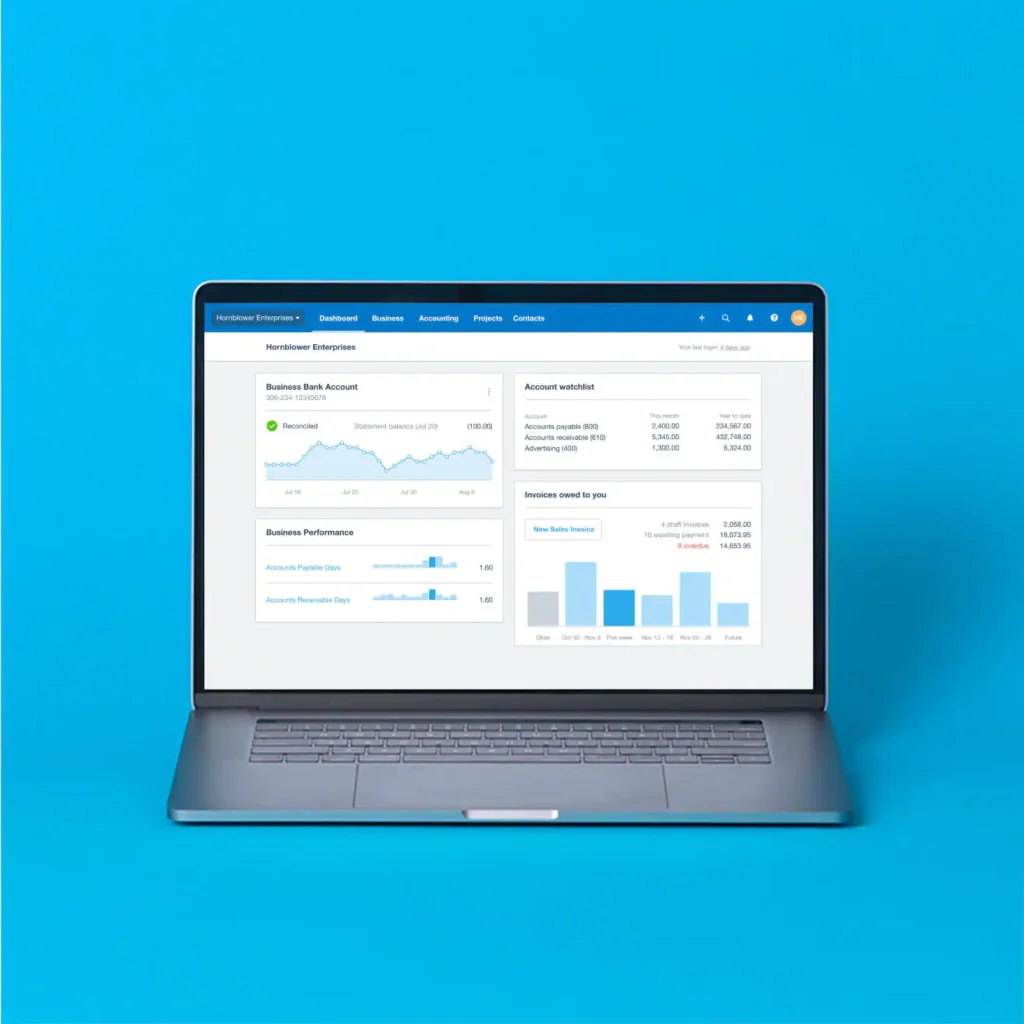

The Accounting Dashboard

Xero’s accounting dashboard provides a real-time snapshot of your financial position. You can track bank balances, outstanding invoices, bills, and more, giving you a day-to-day view of your business’s financial health.

Efficient Fixed Asset Management

For businesses with fixed assets, Xero simplifies tracking and management. Working in collaboration with your accountant, Xero helps you keep your books up to date, ensuring that your fixed assets are accurately accounted for.

App Integration for Enhanced Functionality

One of the standout features of Xero is its ability to integrate with a wide range of apps, third-party software, and financial services. This allows businesses to tailor their Xero experience to their specific needs and enhance their overall efficiency.

The Xero Accounting App

With the Xero accounting app, you can manage your small business from anywhere, even during those seemingly unproductive moments. This mobile app keeps small business owners connected to their financial data, their bank, and their advisors at all times.

To Sum It Up

Xero has emerged as a game-changing solution for small businesses looking to streamline their accounting and financial operations. With its impressive array of features, from expense management to multi-currency accounting and seamless bank reconciliation, Xero offers an integrated platform that simplifies financial tasks and enhances productivity.

As businesses continue to adapt to the digital age, Xero’s online accounting software empowers users with real-time access to their financial data, improving decision-making and reducing the administrative burden. It’s no wonder