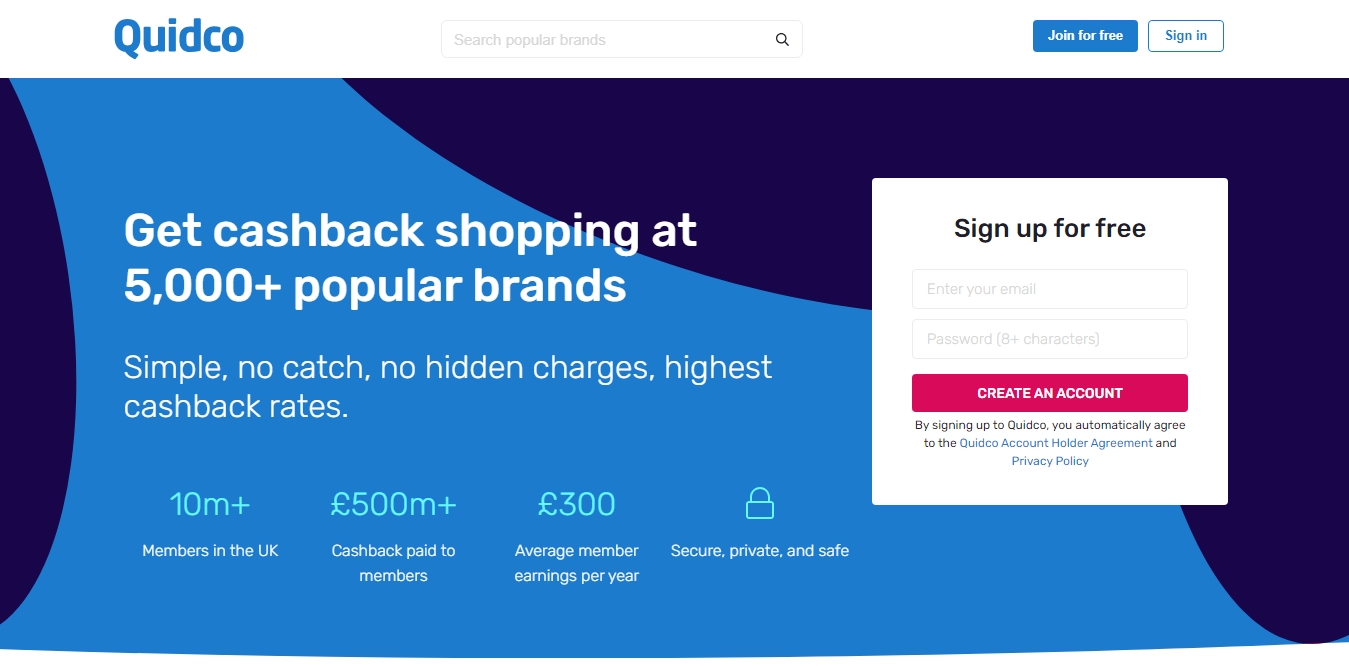

Quidco is a platform where your shopping not only gives you the satisfaction of acquiring quality products but also rewards you with cashback. With over 5,000 popular brands offering the highest cashback rates, Quidco has become the go-to platform for savvy shoppers in the UK. In this blog post, we’ll dive into how Quidco’s cashback system works and, specifically, how you can compare car insurance quotes, potentially saving up to £390* and earning a fantastic £45 cashback.

Understanding Quidco’s Cashback System

Quidco’s cashback system is straightforward and transparent, with no hidden charges or catches. With over 10 million members in the UK and over £500 million in cashback paid, it has proven to be a reliable platform for earning money while you shop. Quidco prides itself on providing the highest cashback rates and even promises to match any higher applicable cashback rate found on other UK cashback sites.

To start earning, all you need to do is shop through Quidco at your favorite brands. The concept is simple – instead of keeping all the advertising money for themselves, Quidco shares a chunk of it back with you in the form of cashback.

Comparing Car Insurance Quotes and Earning £45 Cashback

One of the fantastic opportunities Quidco provides is the chance to compare car insurance quotes and receive £45 cashback. The process is as simple as 1-2-3:

- Get Quotes: Enter your details, and Quidco will find quotes and prices tailored to you.

- Compare: Trustworthy providers such as Admiral, Aviva, and Hastings Direct will present their quotes.

- Get Paid: After purchasing your policy, patiently wait for your cashback, which typically takes 8-10 weeks to appear in your activity and up to 120 days for payment.

Understanding Car Insurance Cover Levels

Before diving into the quote comparison, it’s essential to understand the different levels of car insurance cover available:

- Third Party: Basic coverage, legally required, covers others but not you.

- Third Party, Fire, and Theft: Similar to third party but includes coverage for your vehicle in case of theft or fire.

- Fully Comprehensive: Holistic coverage, includes third party and theft/fire, covers your vehicle even in at-fault incidents.

Interestingly, fully comprehensive coverage might sometimes be more affordable than third-party options.

Details Needed for a Car Insurance Quote

To get an accurate car insurance quote, gather the following details:

- Car details, including the number plate.

- Driving license details, including type, duration, and any convictions.

- Information on previous claims or accidents in the last five years.

- No-claims bonus details.

- Details of any additional drivers.

Choosing the Best Car Insurance Policy:

Multi-car: Insure up to six cars under one provider for potential discounts.

Learner: Short-term insurance for provisional license holders.

Black Box/Telematics: Ideal for proving safe driving habits.

Classic Car: Coverage for cars older than 15 years.

Business: For work-related driving, excluding commuting.

Tips for Affordable Car Insurance

- Compare and Get Cashback: Use Quidco to compare policies and earn £45 cashback.

- Don’t Auto-Renew: Avoid loyalty costs by shopping around for better deals.

- Pay Annually: Save on interest rates by paying yearly.

- Increase Voluntary Excess: Consider paying more in case of a claim for a lower premium.

- Limit Mileage: Lower mileage can decrease perceived risk, potentially reducing costs.

FAQs

Do I need car insurance?

Yes, it’s a legal requirement.

Does my car have insurance?

Check the Motor Insurer’s Database with your number plate.

What is excess in car insurance?

Understand compulsory and voluntary excess.

What are the insurance groups for cars?

Your car falls into one of 50 groups, affecting premiums.

Why is car insurance so expensive?

Factors include personal injury claims, legislative changes, and technology advancements.

When does car insurance go down for a young driver?

It’s not solely age-dependent; adding experienced drivers can help.

Conclusion

Quidco offers a unique opportunity to not only save on car insurance but also earn cashback in the process. With a user-friendly interface and a vast network of reputable brands, Quidco has become a trusted companion for millions of UK shoppers. So, why not leverage the platform to compare car insurance quotes, potentially saving hundreds and pocketing a cool £45 cashback? Start your journey to smarter, more rewarding shopping with Quidco today!