Fast Track Reclaim is an established and FCA regulated leading Claims Management Company with over 12 years experience in Financial Mis-selling Claims and Tax Preparation Services . They are registered with HMRC as agents for tax reclaim services. They have over 10,000 positive customer reviews for their services on the Ekomi independent review website. Click here to check out their latest reviews.

They are experts in both ‘Tax Claims’ and ‘Financial Mis-selling Claims’ and can assist you with the following;

- PPI Tax Claims

- Marriage Tax Claims

- Mileage Tax Claims

- Uniform Tax Claims

- Work From Home Tax Claims

- Mis sold Pension and Investment claims

- Mis sold Packaged Bank Account Claims

- Mis-sold Payday Loan Claims

Having spent years building up great working relationships with many banks/lenders and other financial institutions they have developed specialist processes to identify the key areas of financial mis-selling.

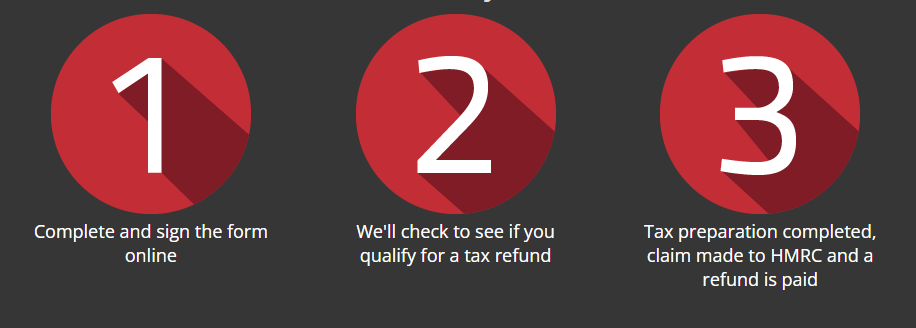

They take the hassle out of the claims process. Simply provide them with a few details and they will quickly assess your chances of making a claim. Generally no paperwork is required as all their claims can be made online.

Marriage Allowance Claims

100% No Win No Fee Compensation Claims

*FEE EXPLANATION: They work on a No Win No Fee basis providing peace of mind that their claims are based on the end result. If your claim is successful they will deduct a fee 36% inclusive of VAT subject to a minimum charge of £30 inc VAT. Where the value of the rebate received from HMRC falls below £30 inc VAT, they will limit their Fee to the total amount of the rebate received. Fast Track Reclaim acts as a Tax intermediary only. You do not have to use Fast Track Reclaim to make a tax refund or allowance request, you could contact HMRC directly.

How to take control of your taxes

Why Can I Claim Marriage Tax Allowance?

You can claim Marriage Allowance if all the following apply:

- You’ve either tied the knot or formed a civil union.

- You or your spouse have an income or Income Tax liability that is less than the Personal Allowance (typically £12,500).

- You or your spouse must have an income between £12,501 and £50,000 before qualifying for Marriage Allowance since you both pay Income Tax at the basic rate.

Your claim can be retroactively processed for up to four years, which translates to a maximum payout of £1220 and potential savings of thousands of pounds in the long run.

Why use them to claim your marriage tax back?

- Their service is prompt, cordial, and effective.

- They base their “no recovery, no fee” promise on the fact that they will not charge you unless they successfully resolve your case.

- They’ve been handling claims for almost a decade now.

- Completely web-based help. No documentation is necessary.

Why Choose Fast Track Reclaim?

- The UK’s Leading Tax Refund Service

- More than a Decade of Experience Handling Claims

- An Entirely Digital Experience

- There Is No Need To Fill Out Any Forms Or Paperwork